tesla tax credit 2021 colorado

On or after january 1 2024 Lets say you owed the federal government 10000 in taxes when filing your 2021. The biggest issue for Tesla though is that the full rebate only applies to Union made vehicles.

Study Product Means More Than Gas Prices In Stoking Ev Demand

For those of you who have already picked up your cars in colorado I have some questions about the tax credit.

. January 1 2023 to December 31 2023. What purchasepickup date would one have to have to qualify for the credit. Colorados credit for new ev purchases dropped to 4000 in january and will be reduced again next year.

Tesla tax credit 2021 colorado Sunday March 6 2022 Edit. Xcels new vehicle lease or purchase rebates are richer than Colorados state new EV tax credit which in 2021 fell to 2500 per vehicle Sobczak noted. Colorado offers a tax credit of up to 4000 for purchasing a new EV and 2000 for leasing one.

I was hoping not to finance that extra money. Save time and file online. Under most emission and rebate rules plug-in hybrids that combine a gasoline engine with a.

After the failure of the Build Back Better bill in late 2021 the existing proposals for the expansion of the EV tax credit were abandoned. The EV tax credit remains at 7500 for all electric models except those made by Tesla and General Motors. The government document says it can be written off to the manufacturer and they must take that price off the car.

This means you cannot be charging your batteries with grid-supplied power which is not too hard. 112020 112021 112023 112026 Electric or plug-in hybrid electric light duty passenger vehicle 5000 4000 2500 2000. Tesla tax credit 2021 georgia.

Beginning on January 1 2021. Updated March 2022. On or after January 1 2024 The Consolidated Appropriations Act of 2021 signed December 27 2020 provided a two-year extension of the.

Many leased EVs also qualify for a credit of 2000 this year and then 1500 for. Or you may opt to e-file through a. So weve got 5500 off a new EV purchase or lease and 3000 off of used.

This puts automakers who were early proponents of electric vehicles like Tesla and GM at a disadvantage. Tesla Model X Tax Write Off 2021-2022. Chevy Bolt Chevy Bolt EUV Tesla Model 3 Kia Niro EV Nissan LEAF Hyundai Kona EV Audi e-tron Rivian R1T Porsche.

You do not need to login to Revenue Online to File a Return. Thats 2-12 months before the credit officially expires but since most Teslas are built to order the company needs some lead time for orders. January 1 2020 to december 31 2022.

Tesla tax credit 2021 colorado. Credit Amounts for Vehicles Leased by Transportation Network Companies Tax year beginning on or after. Contact the Colorado Department of Revenue at 3032387378.

Latest On Tesla Ev Tax Credit February 2022 Why Texas 2 500 Electric Car Incentive Won T Apply If You Buy A Tesla The 2021 Tax Credits Will Take Tesla To The Moon Torque News. You could also be eligible for a tax credit of 5000 for buying or converting a vehicle to electric or 2500 for leasing a. Tesla tax credit 2021 north carolina.

Residential Federal Tax Credit. If you lease cars or trucks for your business you also qualify for the Colorado electric-vehicle tax credit under Income 69. After you file you have the option of setting up a Login ID and Password to view your income tax account in Revenue Online.

What purchasepickup date would one have to have to qualify for the credit. However my delivery specialist said Tesla cannot do that. The main one is that it caps the 7500 tax credit to 200000 electric vehicles per manufacturer.

You may use the Departments free e-file service Revenue Online to file your state income tax. Tesla has given buyers a deadline of Monday to order a car if they want the full 7500. New EV and PHEV buyers can claim a 5000 credit on their income tax return.

Jun 19 2021 1 What is the current assessment of the likelihood of Tesla vehicles again qualifying for the the 7500 US federal government tax credit or possibly 10000 if including made in America provision. Colorado offers a tax credit of up to 4000 for purchasing a new EV and 2000 for leasing one. What is the current assessment of the likelihood of Tesla vehicles again qualifying for the the 7500 US federal government tax credit or possibly 10000 if including made in America provision.

Examples of electric vehicles include. This nonrefundable credit is calculated by a base payment of 2500 plus an additional 417 per kilowatt hour that is in excess of 5 kilowatt hours. The short answer to using the 2021 solar tax credit for battery storage.

Colorado tax credit. If a single person purchases two eligible plug-in electric vehicles with tax credits up to 7500 for each vehicle they should be able to claim 15000 in. The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US.

However as with with the grant above. Colorado offers a tax credit of up to 4000 for purchasing a new ev and 2000 for leasing one. But there is a caveat.

Both the state and the federal government have tax credits. The most recent update was published in april 2021 featuring teslas solar shingle price increases and timing for the solar roof to start appearing in north carolina. Section 179 Deduction Vehicle List 2021-2022.

112017 112020 112021 112023 but prior to. In order to qualify the batteries you choose including a Tesla solar battery must derive 100 of its power from an onsite solar array. Jun 19 2021.

That includes Teslas Powerwall. Tesla has given buyers a deadline of Monday to order a car if they want the full 7500 federal tax credit. Tax credits are available in Colorado for the purchase or lease of electric vehicles and plug-in hybrid electric vehicles.

Tax credits are as follows for vehicles purchased between 2021 and 2026. Electric-Vehicle Tax Credit. The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US.

The credits which began phasing out in January will expire by Jan. Energy storage paired with solar systems are considered qualified expenditures eligible for the tax credit.

Every Ev And Its Range For Late 2021 Roadshow

Pros And Cons Of Buying An Electric Vehicle In 2020 Vs 2021 Aspentimes Com

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Colorado Tax Credit Gives 42 000 Discount On Tesla Roadster The Denver Post

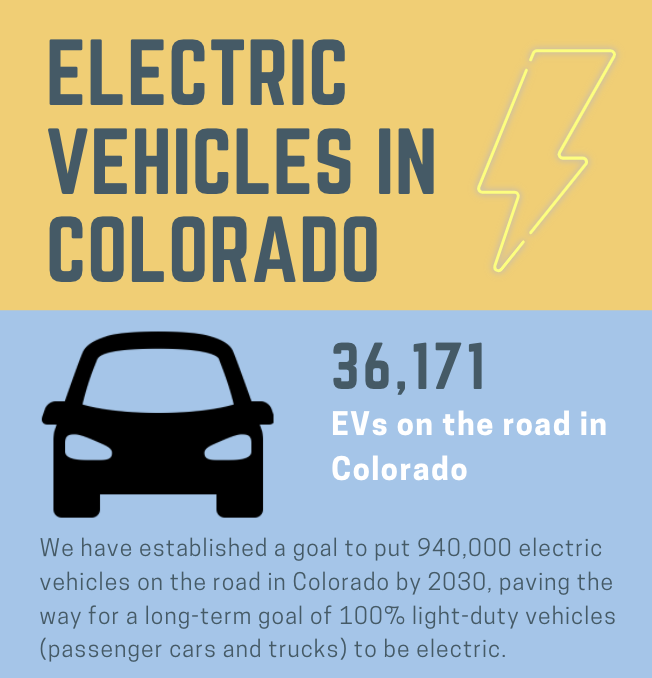

Electric Vehicles In Colorado Report May 2021

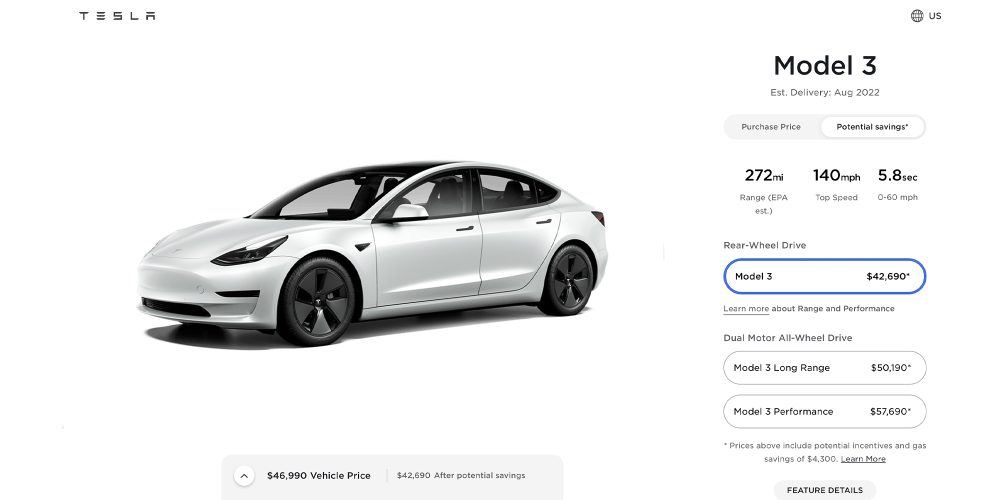

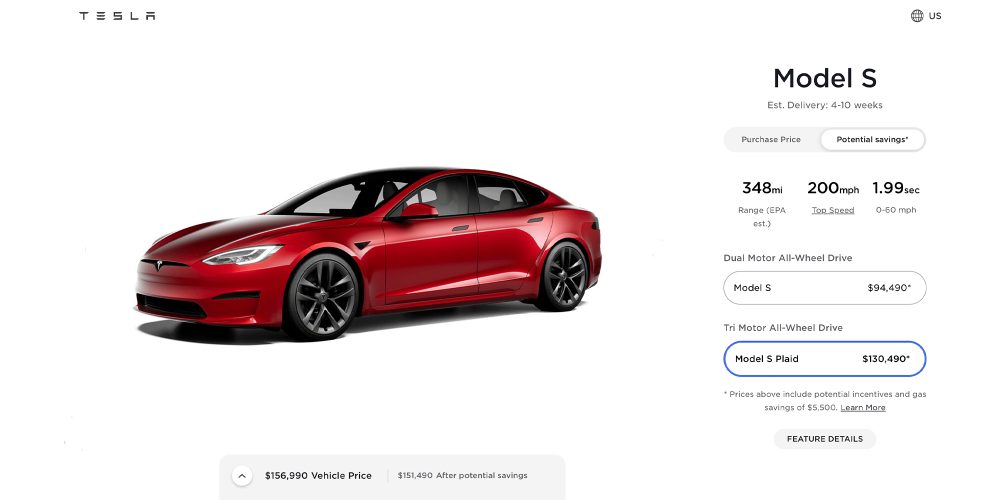

How Much Is A Tesla Prices For Model 3 Model Y And More Electrek

Eligible Vehicles For Tax Credit Drive Electric Northern Colorado

Tax Credits Drive Electric Northern Colorado

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

Updated 17 States Now Charge Fees For Electric Vehicles Greentech Media

Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt Roadshow

Colorado Solar Incentives Colorado Solar Rebates Tax Credits

What Federal Ev Incentives Should There Be If Any

Ev Incentive Hike Faces Tortuous Path Through Congress Forbes Wheels

How Much Is A Tesla Prices For Model 3 Model Y And More Electrek